Mitigating Cost and Abrasion with Electronic Claims Submission

A health plan leverages Availity to significantly reduce paper claims

A health plan leverages Availity to significantly reduce paper claims

One of the largest health insurance plans in the South and Availity, the nation’s largest real-time health information network, recently collaborated to eliminate the submission of paper claims by the health plan’s provider network.

To accomplish this goal, the health plan decided to:

The health plan, along with many members of its provider networks, faced substantial challenges with paper claims. In addition to inefficient manual processes, these claims often resulted in rejection rates up to 73% per month, delayed or lost claims, provider abrasion and increased demand for customer service support. In addition, some clearinghouses used by providers were surreptitiously dropping claims to paper, and many providers were reluctant to submit claims electronically.

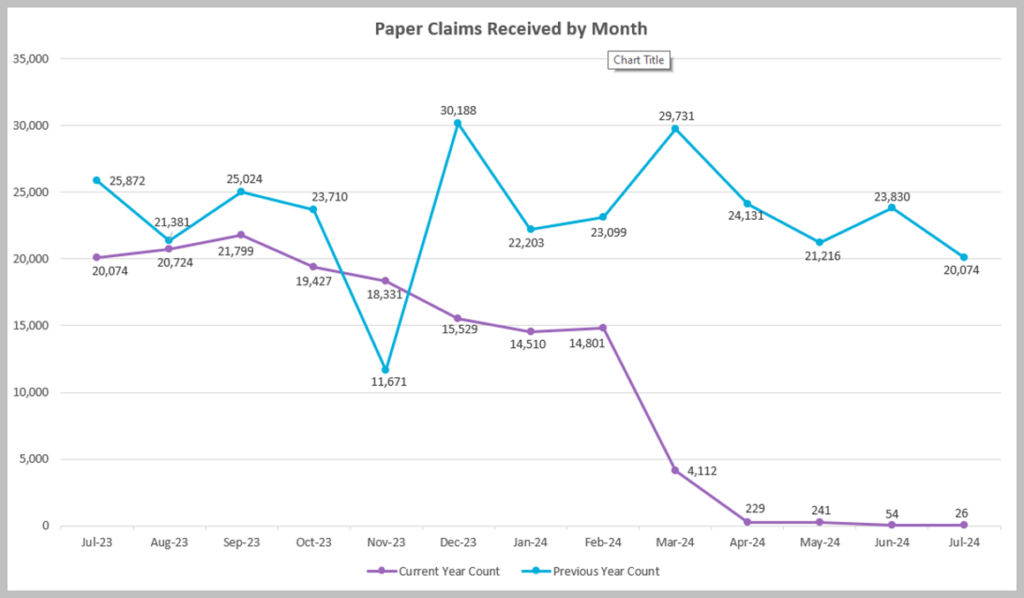

The health plan used a combination of technology, change-management strategies, and provider education to resolve this issue. The implementation date of March 1, 2024, was strategically chosen to avoid the busy open enrollment period and provide additional time to communicate with providers.

The health plan plans to build on the success of this project by exploring additional areas for provider engagement and technology integration. Upcoming initiatives aim to further enhance the efficiency and effectiveness of claims processing.

The transition to electronic claims submission has been a resounding success for the health plan. The benefits of this change are clear: reduced costs, improved provider satisfaction and streamlined operations. This case study serves as a valuable example for other health plans looking to implement similar solutions.